Important Financial Aid Information

Financial aid is the money you receive from federal, state, local, and private programs to help you meet the educational expenses (tuition, fees, books, equipment, supplies, room, board, transportation, and personal expenses) to attend Baptist Health Sciences University.

This information is prepared to help you fully understand the financial aid information provided to you in the financial aid portal. It provides explanations of how your aid offer is determined, and it

outlines the conditions that you must meet in order to maintain eligibility. Please read all information carefully, and keep this as reference for future questions.

Aid Programs

We offer three types of financial aid: scholarships, grants, and student loans. Scholarships are offered based upon academic achievement and do not have to be paid back. Grants are offered based on financial need and do not have to be paid back. All student loans, need based and non-need based, must be repaid.

Please Note: If you have earned an undergraduate degree, you are not eligible to receive any federal grants.

Determining Your Eligibility

Financial need is the difference between the estimated cost of attendance and the family's ability to contribute toward education. The primary responsibility for college expenses start with the student and family. You are responsible for the cost of education to the extent of you and your family's ability and financial aid will be used to supplement the effort of the family. A student who applies for financial assistance must provide information concerning family income and assets for the prior income tax year. Based on the Free Application for Federal Student Aid (FAFSA), a federal formula determines the estimated amount the student and family can expect to contribute toward college expenses.

The Office of Financial Aid determines your financial need by reviewing your expected family contribution (EFC), as reflected on your Student Aid Report (SAR) and subtracted it from your estimated cost to attend Baptist University. Your financial aid package is created through a combination of financial aid programs available through the FAFSA, the State of TN, and BHSU.

Cost of Attendance (budget)

The financial aid office establishes estimated cost of attendance budgets for attending Baptist Health Sciences University each year. These cost of attendance budgets are used to determine a student’s financial need and financial aid eligibility for all the various types of financial aid programs, as well as provide students and their families with an estimate of the TOTAL cost for attending Baptist University over the course of a 12-month period. The total of all financial assistance cannot exceed a student’s cost of attendance budget. For additional information regarding financial aid cost of attendance, please click on this link: BHSU Cost of Attendance.

Enrollment Status

Your aid amounts are subject to change based on your enrollment status. Initial funds are assuming full-time enrollment (12 undergraduate credit hours, or 9 graduate credit hours). However, funds are prorated and disbursed based on actual enrollment as recorded on the last day of the add/drop period for each term. In general, you must enroll at least half time (a minimum of 6 undergraduate credit hours or 4 graduate credit hours) in order to receive most types of financial aid.

Class attendance

Class Attendance is required. If you are reported as never attending or stopped attending a class during the term, your financial aid package may be affected.

Change in Financial Status

The Department of Education requires the Office of Financial Aid at Baptist University to coordinate all sources of financial aid received by students. It is assumed that your financial situation and that of your family will continue as indicated on your FAFSA. Your financial aid package is subject to change due to the receipt of other resources such as outside scholarships, tuition deferral, vocational rehabilitation benefits, employer tuition reimbursement, etc.

The total need-based aid programs (grants, subsidized loans, etc.) plus any other resources, as previously mentioned, cannot exceed your financial need (which is the difference between your total estimated cost of attendance and expected family contribution). The total of all aid programs (need based and non-need based) cannot exceed your total cost of attendance. Report, in writing, any financial aid resources you receive to the Office of Financial Aid within ten (10) days of the change. Remember, scholarships are part of, and not in addition to, your financial aid package.

Accepting Terms and Conditions of Your Aid Offer

You must review and accept the terms and conditions of financial aid before you can accept your offer.

We automatically accept, on your behalf, any merit awards or gift/grant aid. If you will be acceptingor declining any loans you have been offered, you must accept or decline them on your offer letter. You must complete these processes before you can receive any financial aid funds.

Baptist Health Sciences University Scholarships

If your aid package includes a BHSU scholarship, you must meet the conditions of their scholarshipsi as stated in your signed scholarship offer.

Tennessee Student Assistance Grant and Hope Lottery Scholarship Programs

The Tennessee Student Assistance Corporation (TSAC) is a grant for early applicants whose EFC is within a predetermined range. If your aid package includes the TSAC grant, the amount of your grant is determined by TSAC, and the actual disbursed grant is based on your enrolled hours.

The Hope Lottery Scholarship Program awards are based on certain academic and/or need based criteria set by the Tennessee legislature. If your aid package includes a Hope Lottery Scholarship Program award, you are responsible for being knowledgeable of the rules for receiving and maintaining the aid. For more information on these requirements, please visit the site for HOPE Lottery Scholarship Programs.

Federal Direct Student Loans

We encourage you to maintain a conservative borrowing program within the recommended amounts so as not to overburden yourself with debt repayment upon graduation. If at any time you feel that you need to review your student loan portfolio, we encourage you to go online to view your student loan history. You may also make an appointment with a financial aid officer to discuss loan options that are available to you. Our goal is to assist you in taking advantage of the most beneficial loan programs based on your particular situation.

Accepting Your Loan

If you have been offered a Federal Direct Subsidized or Unsubsidized Loan for the first time at Baptist College, you must complete your online Entrance Counseling session requirement and your new Master Promissory Note (MPN) for the Federal Direct Loan Program(s). You will be notified of the specific terms and conditions of a loan offer made from a particular program in the promissory note and any necessary accompanying information. These federal requirements for your loan must be completed online. Remember, you cannot receive funds through the Federal Direct program until you complete the entrance counseling process and complete the MPN.

Student Loans -Special Note: Although Baptist University may offer you a student loan to help you meet your university expenses, you should seriously consider if you would need a student loan to attend college. You may borrow less than the Office of Financial Aid has recommended. Remember - ALL student loans must be repaid.

If you are receiving a Federal Parent PLUS Loan, your parent is borrowing through this program on your behalf. Your parent(s) must apply for the Federal Parent PLUS Loan program online. If your parent is approved for the PLUS Loan, they must sign a PLUS Master Promissory Note (MPN) online, and they can choose to borrow up to the students cost of attendance minus the student's financial aid accepted. If your parent is denied for the Federal Parent PLUS Loan, you will automatically be considered for additional Federal Direct Unsubsidized Loan up to $4,000 or $5,000 depending on your grade level.

If you want to receive a Federal Graduate PLUS Loan, you must apply for the Federal Graduate PLUS Loan program online. If you are approved for the Graduate PLUS Loan, you must sign a PLUS Master Promissory Note (MPN) online, and you can choose to borrow up to your cost of attendance minus the financial aid you have accepted.

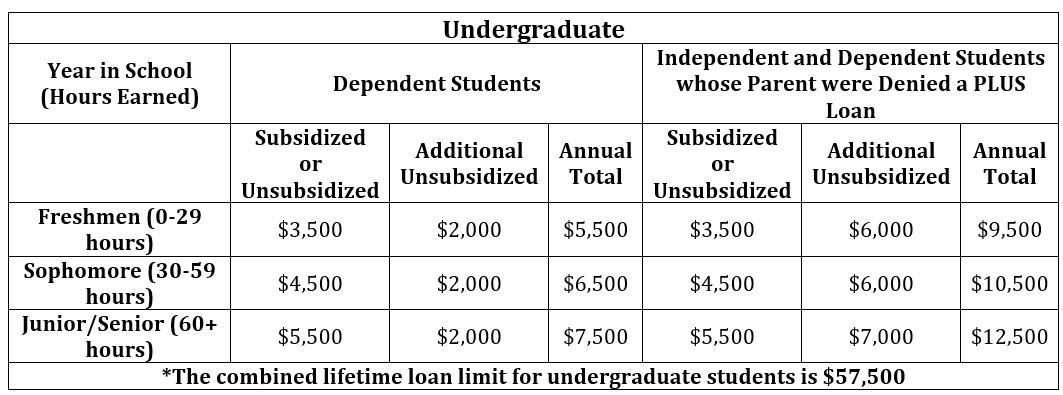

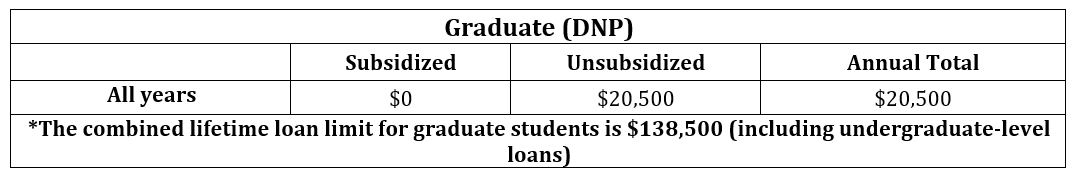

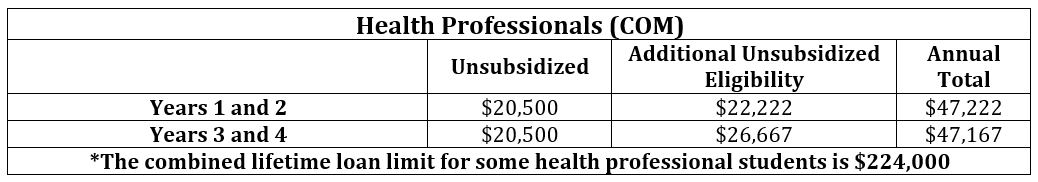

Annual Federal Loan limits

Below you will find a chart that identifies the annual limits for the Federal Direct Loan Program. These limits are established accordingly to federal regulations and cannot be increased.

Direct Loan Programs

Student Aid Program |

Type of Aid |

Other Information | Annual Loan Amounts |

Federal Direct Subsidized Loan |

Loan: must be repaid | The US government pays interest while the student is in school at least half-time. This loan is not credit-based | $3,500 to $5,500, depending on grade level and need |

Federal Direct Unsubsidized Loan |

Loan: must be repaid | The student is responsible for the interest during the life of the loan. This loan is not credit-based. | $2,000 to $12,500, depending on grade level |

| Federal Direct Parent PLUS Loan |

Loan: must be repaid | The parent borrows on the student's behalf and is responsible for the interest during the life of the loan. This loans is credit-based | Cost of attendance, less other financial aid received |

| Federal Direct Graduate PLUS Loan |

Loan: must be repaid | The student borrows and is responsible for the interest during the life of the loan. This loan is credit-based. | Cost of attendance, less other financial aid received |

Disbursement of Financial Aid Funds

The Office of Financial Aid monitors the courses in which you are enrolled. When the disbursement of your financial aid occurs, only those units applicable to your degree will be considered part of your hour requirement. Federal financial aid is electronically received from the federal aid programs. Funds are credited to each student's account, to be used at registration, after the student's financial aid application file has been completed. The funds are originated with the federal agencies for processing, and for loans, after you have completed your online entrance counseling session and MPN. Provided all requirements are met, within 14 days of the first day of class, your financial aid funds will be disbursed. Financial aid is then credited to your student account. If a credit balance remains after all financial aid funds have been applied to the student's account, the Business Office will refund any aid after fees and other charges are paid. We encourage students to sign up for direct deposit for federal refunds with the Business Office to ensure faster processing of your refund (if applicable). If not, refund checks are mailed within 14 days. All refunds checks are mailed directly to the student at the address reflected in the Registrar's Office.

Withdrawal

Federal regulations require the reduction of your financial aid if you totally withdraw or stop attending prior to completing 60% of the term. The reduction is based on the percentage of the term that you do not attend. The withdrawal can result in you having to repay financial aid funds, including grants.

Your Student Account

The Office of Financial Aid determines eligibility and awards financial aid based on established criteria. The Business Office is responsible for charges on your student account, making payment arrangements, sending invoices for any past due payments, and accepting payments on your student account. If you have any questions regarding your student account, please contact the Business Office at 901-575-2247.

Change of Address

The Office of Financial Aid utilizes the primary address on file with the Registrar's Office when mailing specific documents. If during the year you change your address, please notify the Registrar's Office at 901-572-2452.

Baptist University Issued Email Address

Your Baptist University email address is the primary method of communication for the Financial Aid Office in addition to the University. Please check your University email often as this is how we will communicate additional information requests and/or changes to your aid status. Do not let your financial aid process become delayed because you forgot to check your email.

** If you have questions, please contact the Financial Aid Office at 901-575-2247 or at [email protected]

IMPORTANT:

The Student Financial Aid Office reserves the right to adjust your awards due to changes in your eligibility and/or the availability of funds. If an error was made, whether by you, the Student Financial Aid Office, or another agency, federal regulations require that the error be corrected and funds may be billed back as necessary.